Tier 1 Leverage Ratio

Tier 1 Leverage Ratio is a measurement of bank core capital to its total assets and can be calculated as Tier 1 Capital as a Percentage of Average Total Assets. The ratio was introduced by Basel III to be used to judge how a bank is leveraged in terms of capital when compared to its consolidated assets. The formula can be defined as:

Tier 1 Leverage Ratio = (Tier 1 Capital / Consolidated Assets) * 100

Tier 1 Capital is the core capital of a bank and consists of the most stable and liquid capital as well as the most effective at absorbing losses during crisis times. The consolidated assets include the average total assets and total assets for leverage capital purposes.

The computation, in general, is done with Consolidated Assets that is taken from the UBPR metric Total Assets for Leverage Ratio (UBPRA224), thus making the formula for the leverage ratio as:

Leverage Ratio = (UBPR8274 / UBPRA224) * 100

Some regulators prefer to compute this ratio with the Total Consolidated Assets prior to deductions. In such a case the formula for the leverage ratio would be:

Leverage Ratio = (UBPR8274 / UBPRL138) * 100

While Basel III established a 3% minimum requirement for the Tier 1 leverage ratio, the federal regulators require a minimum of 5% to be considered a bank as well capitalized. With congress having passed new rules regarding community bank leverage ratio (CBLR) under bill S.2155 (Sec. 201), community banks may have option to choose between CBLR and Tier 1 Leverage Ratio. While the current Tier 1 Leverage Ratio minimum threshold holds around 5%, the CBLR threshold is at 9%.

UBQuant Difference

UBQuant defines the Tier 1 Leverage ratio under Critical Ratios (Capital) for customers to access the computed outcomes instantly and trend with peer groups, either pre-defined or custom defined to specific benchmark needs.

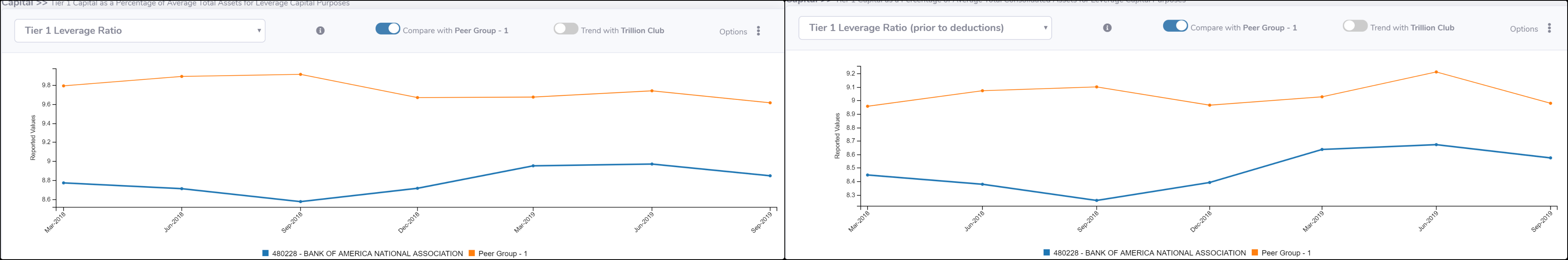

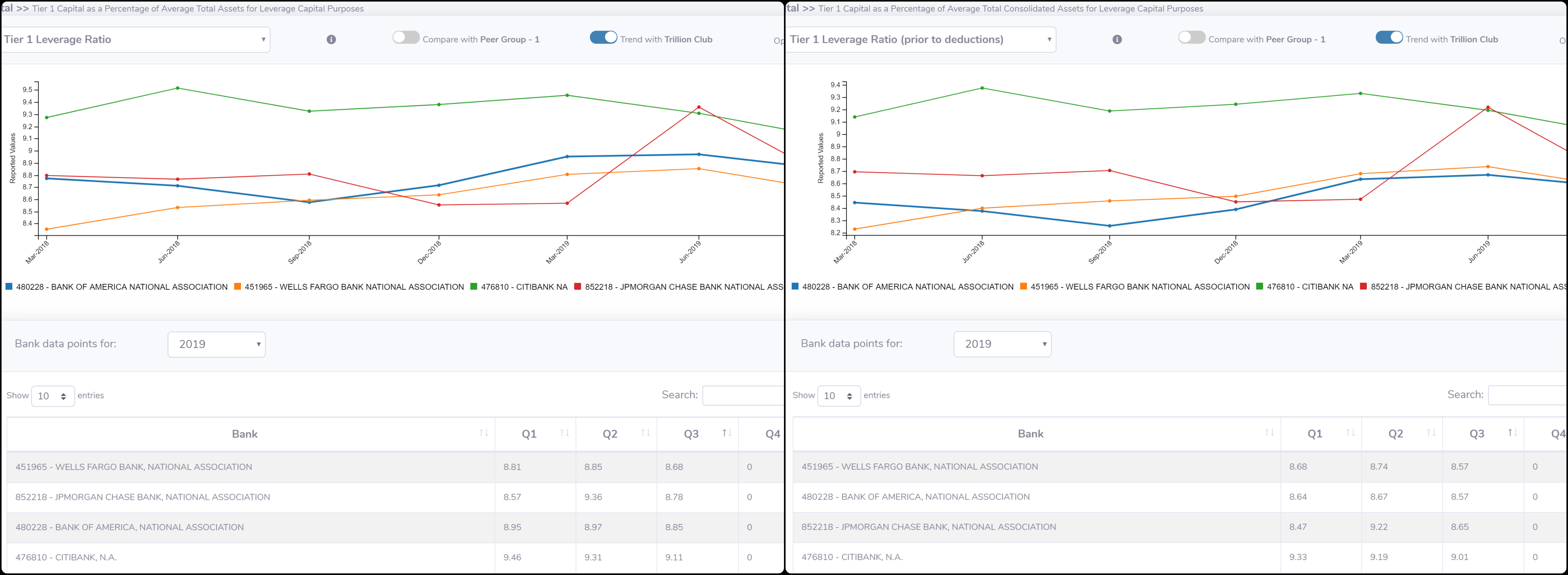

For Bank of America, computing this using both methodologies and compare/trending with similar sized banks yields results like below:

Bank of America Tier 1 Leverage Ratio trending with Peer Group 1

Bank of America trending with custom Watch List Banks

* Updated on 11/06/2019 for Q3 data