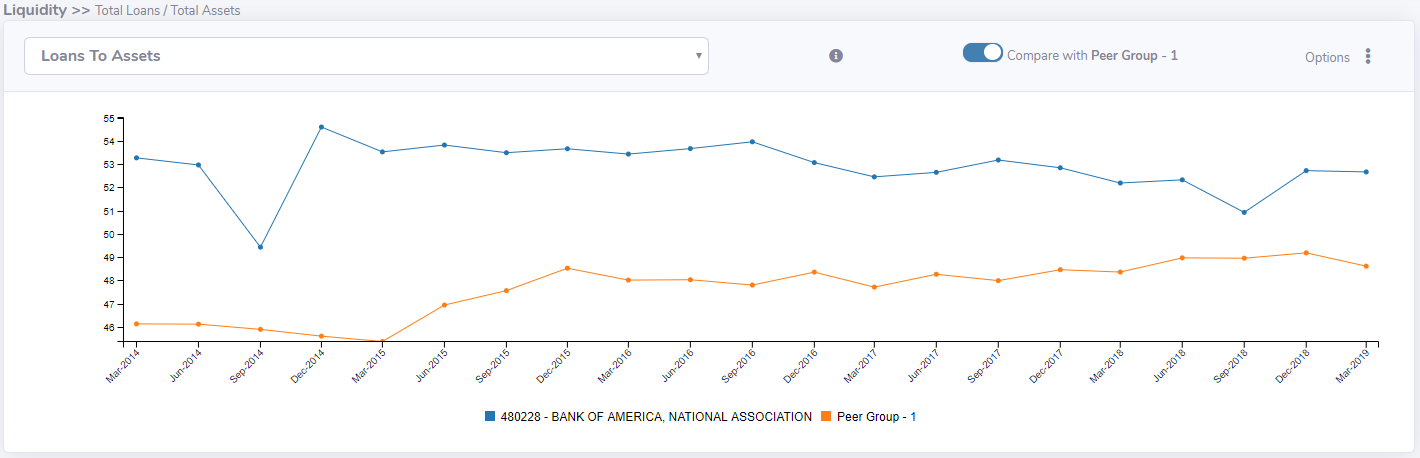

Loans to Assets Ratio

The Loans to Assets Ratio is a measurement of bank total assets that are invested in loans. This is a critical liquidity ratio that provides insight into credit risk of the bank, where higher the percentage indicates the increased risk.

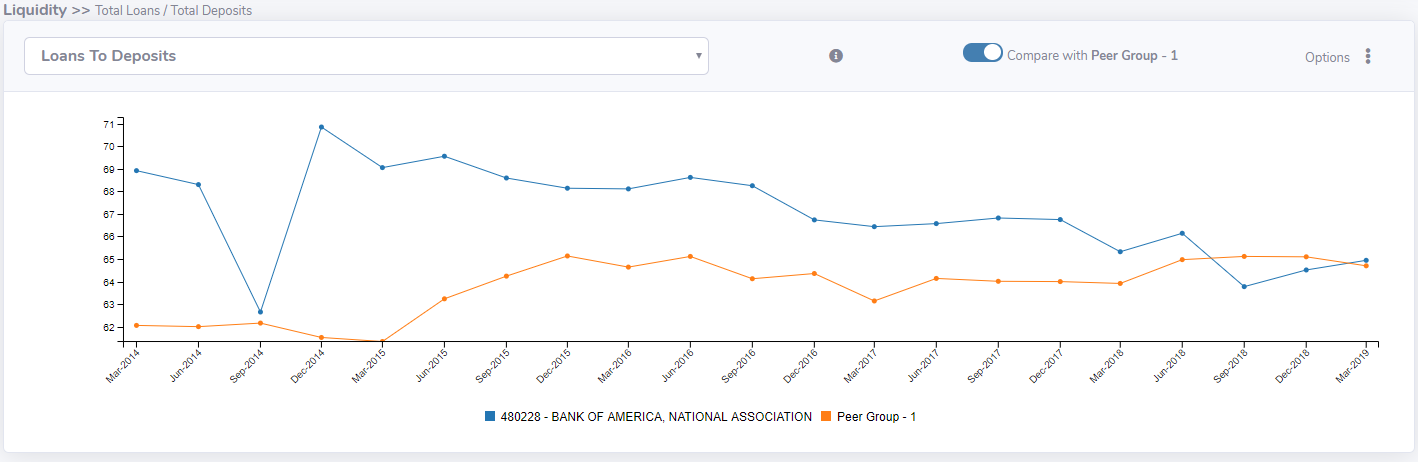

As part of the asset quality, along with this ratio, the Loans to Deposits Ratio also will need to be evaluated. The loans to deposits ratio measure the multiple of bank deposits capital that is invested in loans. When either ratio is trending high, the risk of impacts on credit quality would rise as well.

Compare with you benchmarking peers, to measure and keep operating at safe levels and to get insights when trending higher into factors that are affecting your bank during adverse events.

UBQuant Difference

UBQuant defines the Loans to Assets ratio, and also Loans to Deposits ratio, under Critical Ratios (Liquidity) for customers to access the computed outcomes instantly and trend with peer groups, either pre-defined or custom defined to specific benchmark needs.

Bank of America trending with Peer Group 1