Bank Efficiency Ratio

In today’s environment, one of the most significant ongoing concerns for bank executives is to carefully orchestrate growth with controlled spending. Efficiency ratio, in general, is the measure of the banks effective spending - a positive operating leverage. By definition, the efficiency ratio can be calculated as:

Efficiency Ratio = Non-Interest Expenses/ (Operating Income – Loan Loss Provision)

Viewed simplistically, this valuable metric may be misleading when not fully understood what we can derive when we are not capturing the growth picture in our comparisons. Efficiency ratio is a form of indicator on the profitability and a measurement of how bank is spending, and typically we desire to see this to be lower and balanced when compared to our peers. An important aspect to understand with this ratio is that two banks with same efficiency ratio my not be equals and may not be valued equally. While one bank may be low-cost producer the other might be growth oriented. In either case, when benchmarking our story, we need to establish what’s our evaluation target is and pick our peers accordingly to compare.

The bank UBPR reports provide this ratio under "Noninterest Income, Expenses and Yields" section (UBPRE088) Total Overhead Expense expressed as a percentage of Net Interest Income (TE) plus Noninterest Income. Trend with the relevant peer groups, download reports for your top competitors and evaluate historical trends; especially during tough years for more valuable insights.

For those of you advanced users, this ratio can be also computed directly from the mix of Call and UBPR metrics and with UBQuant you could define your own custom ratio (myFormula) for this ratio as: Total Non-Interest Expense / (Net Interest Income + Total Non-Interest Income)

Efficiency Ratio = RIAD4093 / (UBPR4074 + RIAD4079)

UBQuant Difference

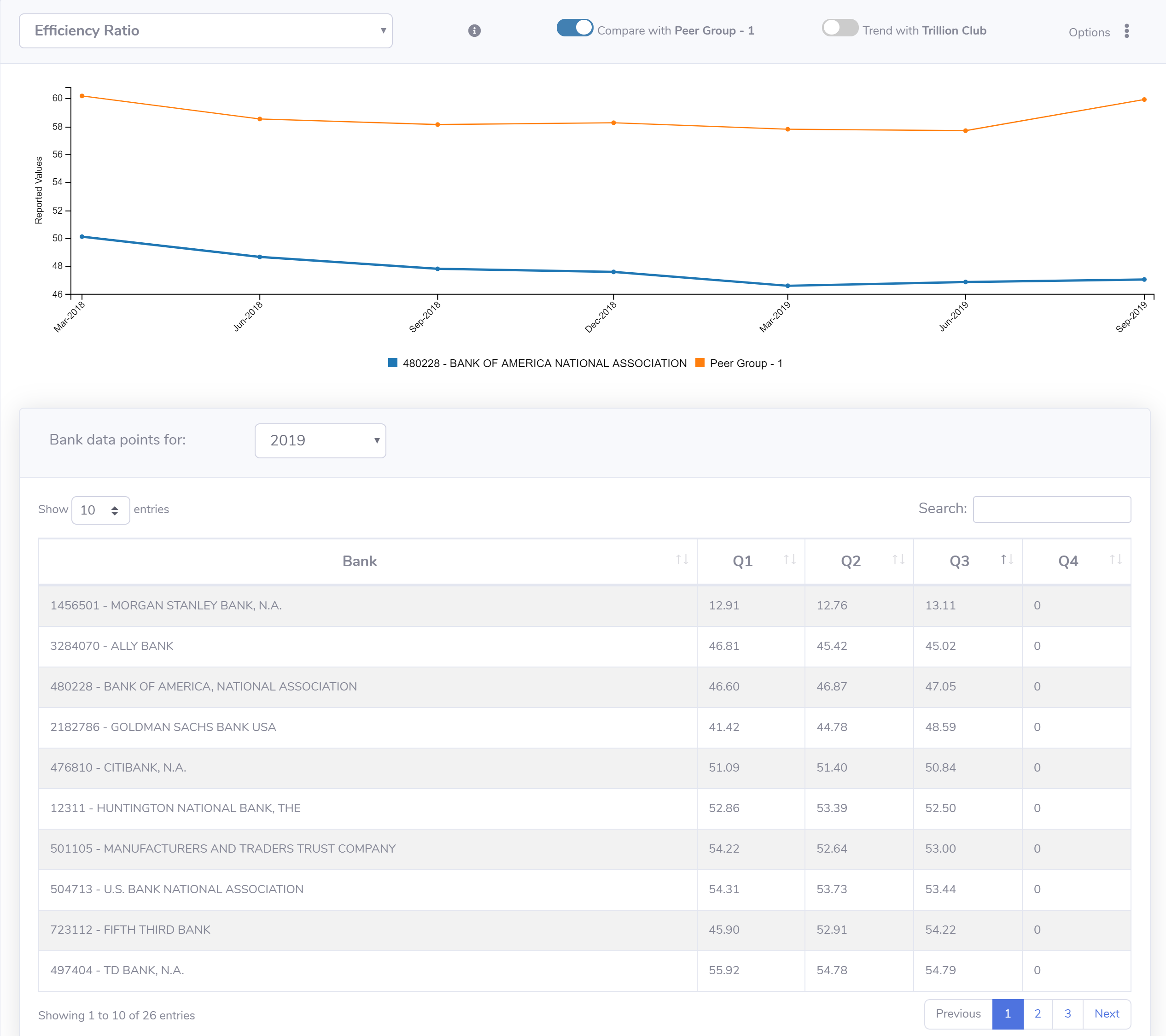

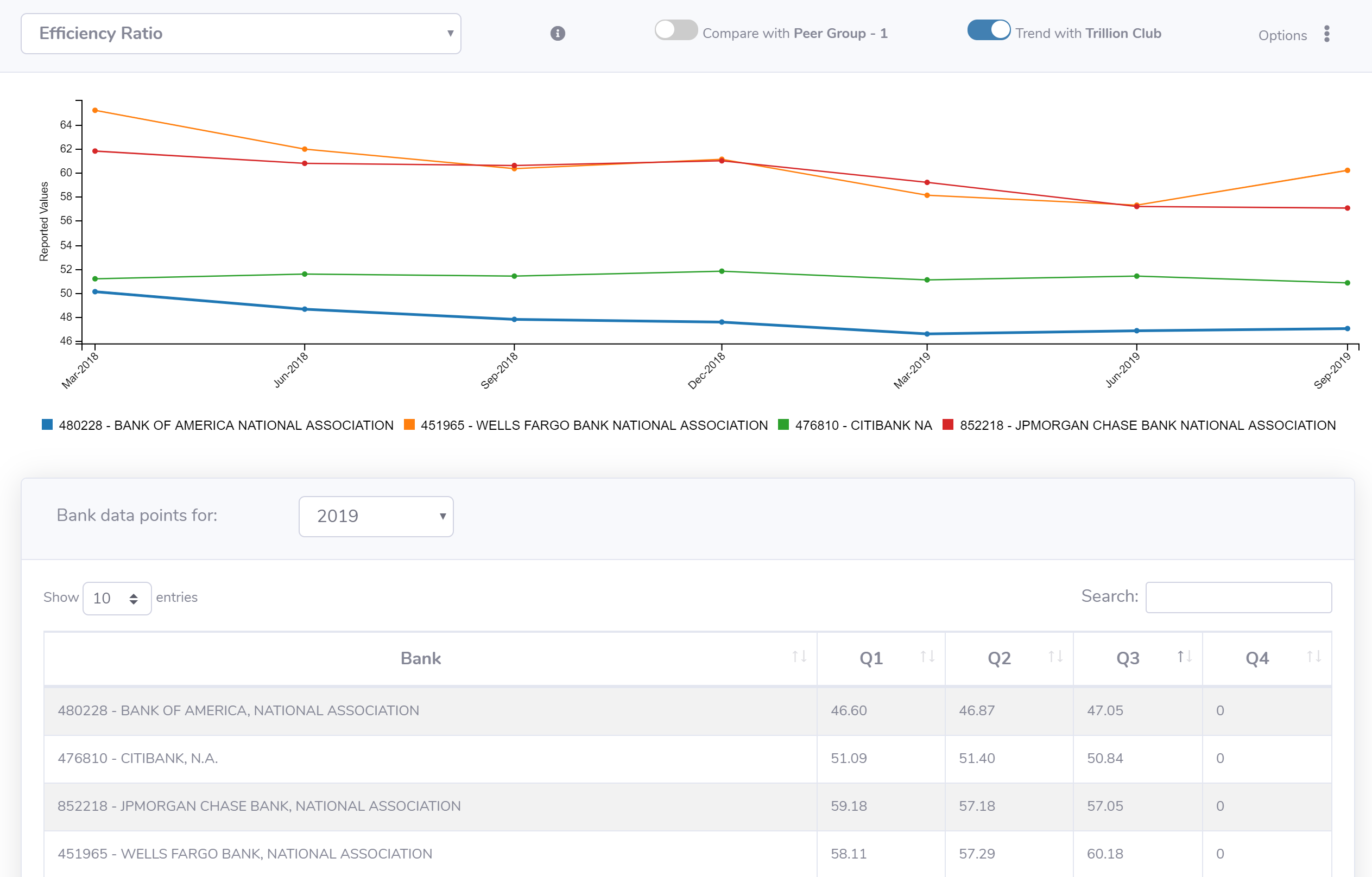

With UBQuant, we let our customers analyze this ratio and others with ease. You can compare with custom peer groups, your set of banks of target, tabularize, visualize, trend with watchlists and more.

Bank of America trending with Peer Group 1

Bank of America trending with custom Watch List Banks

* Updated on 11/06/2019 for Q3 data